The media account is biased leaving the public uninformed. (As usual)

In early January 2026, U.S. forces executed a daring military operation to capture Venezuelan President Nicolás Maduro, marking a dramatic shift in U.S. policy toward the troubled South American nation.

President Donald Trump announced the capture triumphantly, declaring that the United States would temporarily “run” Venezuela and prioritize access to its vast oil reserves—the largest proven in the world, estimated at over 300 billion barrels.

Mr. Trump framed the move as a reclamation of resources…

and a blow against drug trafficking, emphasizing that American oil companies would invest billions to rebuild dilapidated infrastructure, allowing the U.S. to extract “tremendous wealth” without cost to taxpayers. His blunt rhetoric suggested direct control, with Venezuela “handing over” 30-50 million barrels of oil worth $2-3 billion at current West Texas Intermediate (WTI) prices around $57-58 per barrel.

However, Secretary of State Marco Rubio quickly provided a more nuanced clarification.

While acknowledging U.S. leverage, Rubio stressed that America would not directly govern Venezuela but would maintain a “military quarantine”—essentially a blockade—on certain oil exports to coerce policy changes. This approach aligns with Rubio’s long-standing advocacy for regime pressure through economic tools rather than outright occupation.

The goal, he explained, is to ensure the oil industry benefits the Venezuelan people, halts alleged drug trafficking, and prevents adversaries like Iran, Cuba, or China from dominating the sector. Rubio’s strategy relies on sanctions and incentives, using control over exports to push for transparency, foreign investment (preferably American), and governance reforms without committing to nation-building.

This divergence in messaging—Trump’s direct dominance versus Rubio’s indirect influence—highlights a stylistic gap but a shared objective: securing U.S. interests in Venezuelan oil while positioning the intervention as beneficial. The operation’s rapid execution left transition plans vague, but reports indicate Rubio played a central role in planning, suggesting coordination despite public contrasts.

At the heart of this policy is Venezuela’s oil economy, long crippled by mismanagement, corruption, and sanctions.

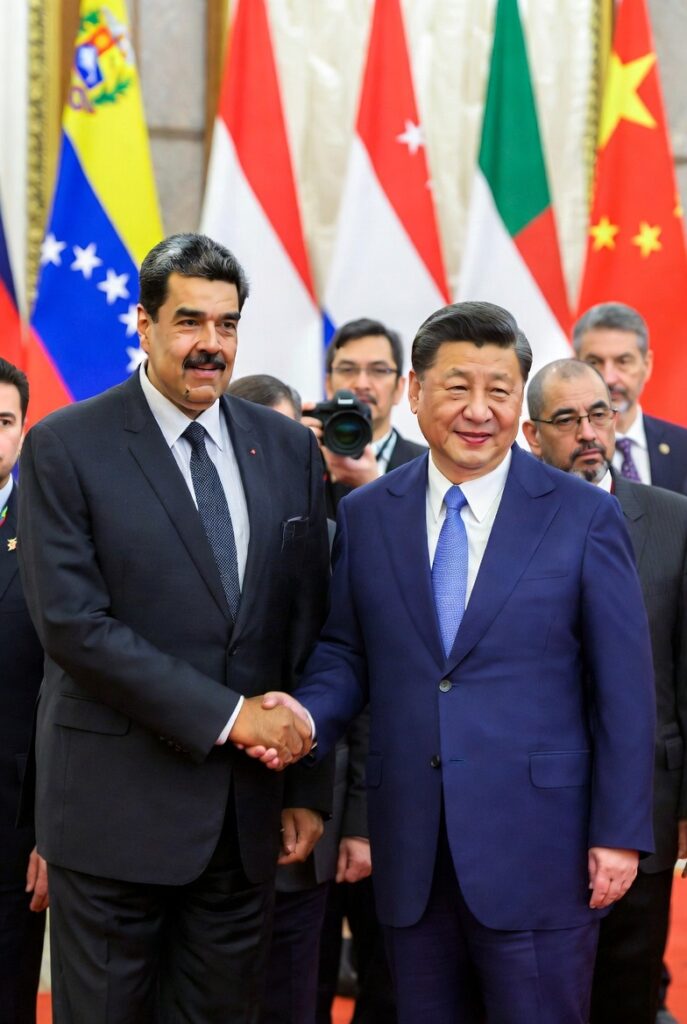

Under Maduro, production plummeted from peaks of 3.5 million barrels per day (bpd) in the late 1990s to around 900,000-1.1 million bpd in late 2025. Exports, vital for revenue (over 90% of foreign earnings), were severely constrained. China emerged as the primary buyer, importing about 470,000 bpd—roughly 80% of Venezuela’s seaborne exports—often at steep discounts of 10-20% below market rates like WTI at Cushing.

These deals stemmed from over $100 billion in Chinese loans since the 2000s, with outstanding debt estimated at $10-19 billion.

Roughly one-third of shipments serviced this debt directly, leaving little cash. The remainder faced high costs: Venezuelan extra-heavy crude requires expensive diluents (20-30% blend ratio, costing $15-25 per barrel) due to lack of domestic supply, plus elevated lifting expenses from decayed infrastructure ($10-20 per barrel). Corruption skimmed much of what remained, funding regime elites rather than public services. For illustration, consider 10 barrels at a market price of $580 (near $58/barrel WTI):

Discounted to China: ~$480-500.

Debt slice (1/3): Subtract ~$160-167, leaving ~$313-333.

Blending costs: ~$180-250.

Lifting/other: ~$150-200.

Net: Often near zero or negative, with scraps diverted to cronies.

This system exacerbated Venezuela’s humanitarian crisis—hyperinflation, starvation, and mass exodus—while providing minimal relief to ordinary citizens.

The U.S.-influenced shift could dramatically alter this. By redirecting exports to market-priced sales (e.g., to U.S. Gulf Coast refineries optimized for heavy sour crude), revenues could surge. The same 10 barrels at full price might gross $580, minus ~$300-400 in costs, netting $180-280—potentially 5-10 times more per barrel. An initial agreement for 30-50 million barrels could yield $2-4 billion, with proceeds potentially escrowed for humanitarian aid, infrastructure, or debt restructuring. Long-term, U.S. firms investing $100+ billion could ramp production toward 2-3 million bpd, creating jobs and stable revenue.

Crucially, U.S. political accountability differs from China’s opaque model.

Domestic and international scrutiny—from Congress, NGOs, and allies—would demand transparent allocation, prioritizing aid over extraction to avoid backlash. Rubio has emphasized changes “beneficial to the Venezuelan people,” opening paths for food, medicine, and rebuilding bypassed under the old regime. China loses discounted supply and debt leverage, forcing higher-cost sourcing elsewhere.

Yet caveats abound:

Rebuilding takes years amid political instability; total Venezuelan debt (~$150-170 billion) looms; and mismanagement risks persist without robust oversight. Still, ending elite capture and debt servicing to adversaries could mark a profound win for Venezuelans, transforming oil from a curse into a resource for recovery.

Mainstream media coverage, however, has largely failed to engage this economic analysis intelligently.

Outlets like The New York Times, The Guardian, and Al Jazeera fixate on Trump’s “gunboat diplomacy,” framing the intervention as illegal resource grabs echoing Iraq or 19th-century imperialism. Headlines decry violations of sovereignty, potential occupation, and oil motives as excuses for aggression, often amplifying condemnations from Russia, Iran, Cuba, and Latin American leftists. Critical voices highlight risks of prolonged instability or profiteering by U.S. firms, portraying the move as reckless unilateralism.

Deeper dives into oil mechanics—how discounted Chinese deals starved the population while market access could fund relief—are scarce.

Few explore the math of proceeds potentially multiplying benefits for citizens under transparent U.S. oversight, versus opaque skimming before. This omission stems partly from partisan lenses: Many outlets view Trump-era actions through skepticism, prioritizing legal/ethical critiques over pragmatic outcomes. The story’s shock value—audacious raid, sovereignty breach—dominates, sidelining nuanced economics amid fast-breaking events. Sensationalism sells, but it obscures how redirecting revenues from cronies and creditors to aid could alleviate suffering for millions. Balanced reporting requires examining not just motives, but measurable impacts on Venezuelans long denied their nation’s wealth.

In sum, the Venezuela intervention blends realpolitik with opportunity.

While risks of backlash and overreach persist, the economic reconfiguration offers a rare chance to break cycles of poverty and corruption—if executed with the transparency U.S. constraints demand.

That said, it’s unlikely that the American people will understand what’s happening due to the media and influencers creating a narrative based on memes, politics and trying to gain market share. Until western media detaches from running fast food and drug commercials, there will be no truth.